Last Tuesday at 10:23 PM, after Charles was finally asleep, my colleague Tanaka-san texted me. I was at the kitchen table reviewing our FIRE spreadsheet when my phone lit up.

"J-REITs are paying 5% now. You need ¥100 million vs your ¥143 million in オルカン(global low cost index fund) for the same ¥5 million income. Why aren't you switching?"

I stared at that text for twenty minutes. Calculator app open. Spreadsheet glowing. The math was right there. ¥100 million at 5% yield equals ¥5 million in annual distributions. My plan needs ¥143 million in オルカン to safely withdraw ¥5 million at 3.5%. That's a ¥43 million gap.

Tanaka-san has been vocal about his J-REIT strategy at work. He's got about ¥8 million in the Tokyo Stock Exchange REIT Index ETF, pulling in roughly ¥400,000 per year in distributions. He posts screenshots in our work chat. Monthly deposits. Visible income. The dream of Dividend Lifestyle that resonates deeply in Japanese investment culture.

My wife walked in to get water. She saw me staring at my phone. "What's wrong?"

"Tanaka-san thinks I'm doing FIRE the hard way. Maybe he's right."

She glanced at my screen. "What's he suggesting?"

"J-REITs. Real estate investment trusts. 5% yield. I'd need ¥43 million less to hit the same income."

She was quiet for a moment. "What's the catch?"

That's the question I spent the next two hours answering. By midnight, I'd run three different 20-year projections. The catch isn't just one thing. It's three hidden costs that compound over decades. And by the time I finished calculating, I realized that 5% yield Tanaka-san is so proud of would cost our family roughly ¥16 million in tax drag alone. That's before considering the growth ceiling or interest rate sensitivity.

Table of Contents

Here's what makes J-REITs seductive: the distributions arrive like clockwork. Tanaka-san gets his deposits monthly or quarterly depending on his specific holdings. Visible yen hitting his account. It feels like salary. It feels safe.

But every single distribution gets taxed at 20.315% before it reaches his account. Not just the gains. The entire distribution.

Let me show you what that looks like over 20 years.

J-REIT Path (¥100M portfolio, 5% yield):

Year 1 distribution: ¥5,000,000

Tax withheld: ¥1,015,750

Net received: ¥3,984,250

Annual tax cost: ¥1,015,750

Over 20 years at constant 5% distributions:

Total distributions: ¥100,000,000

Total tax withheld: ¥20,315,000

Total net received: ¥79,685,000

オルカン Path (¥143M portfolio, 3.5% withdrawal via 定期売却(Regular sale):

Year 1 withdrawal: ¥5,000,000

Estimated gain portion (assuming 80% principal, 20% gain): ¥1,000,000

Tax on gains only: ¥203,150

Net received: ¥4,796,850

Annual tax cost: ¥203,150

Over 20 years with systematic withdrawal:

Total withdrawn: ¥100,000,000

Total tax paid (on gains only): ~¥4,000,000

Total net received: ~¥96,000,000

The difference in tax drag alone is roughly ¥16 million over 20 years. That's not accounting for portfolio growth. That's just the mechanical difference in how distributions versus capital gains get taxed.

When I showed my wife this calculation, she was quiet for a long moment. "¥16 million is more than we're planning to spend in three years of retirement."

Exactly. The tax treatment isn't a minor technical detail. It's the difference between funding Charles's university entirely or needing to work part-time in our sixties to cover the shortfall.

The tax trap is just the first problem. The second is more insidious because it sneaks up on you over decades.

J-REITs must distribute 90% or more of their income to shareholders to avoid corporate taxation. That's the legal structure. It's not optional. This means J-REITs retain almost nothing for growth. They can't reinvest significant earnings into new properties or improvements. Growth comes primarily from taking on debt or issuing new shares to buy more real estate.

Compare that to オルカン. The fund owns businesses that retain earnings, reinvest in growth, expand internationally, develop new products. Over the long term, this drives capital appreciation. My ¥143 million today could grow to ¥200 million or ¥250 million over 15 years even while I'm withdrawing from it, assuming historical equity returns.

But Tanaka-san's ¥100 million in J-REITs? It's probably still ¥100 million in 15 years. Maybe ¥110 million if he reinvests distributions and property values appreciate modestly. But fundamentally, the principal stays flat because J-REITs are income vehicles, not growth vehicles.

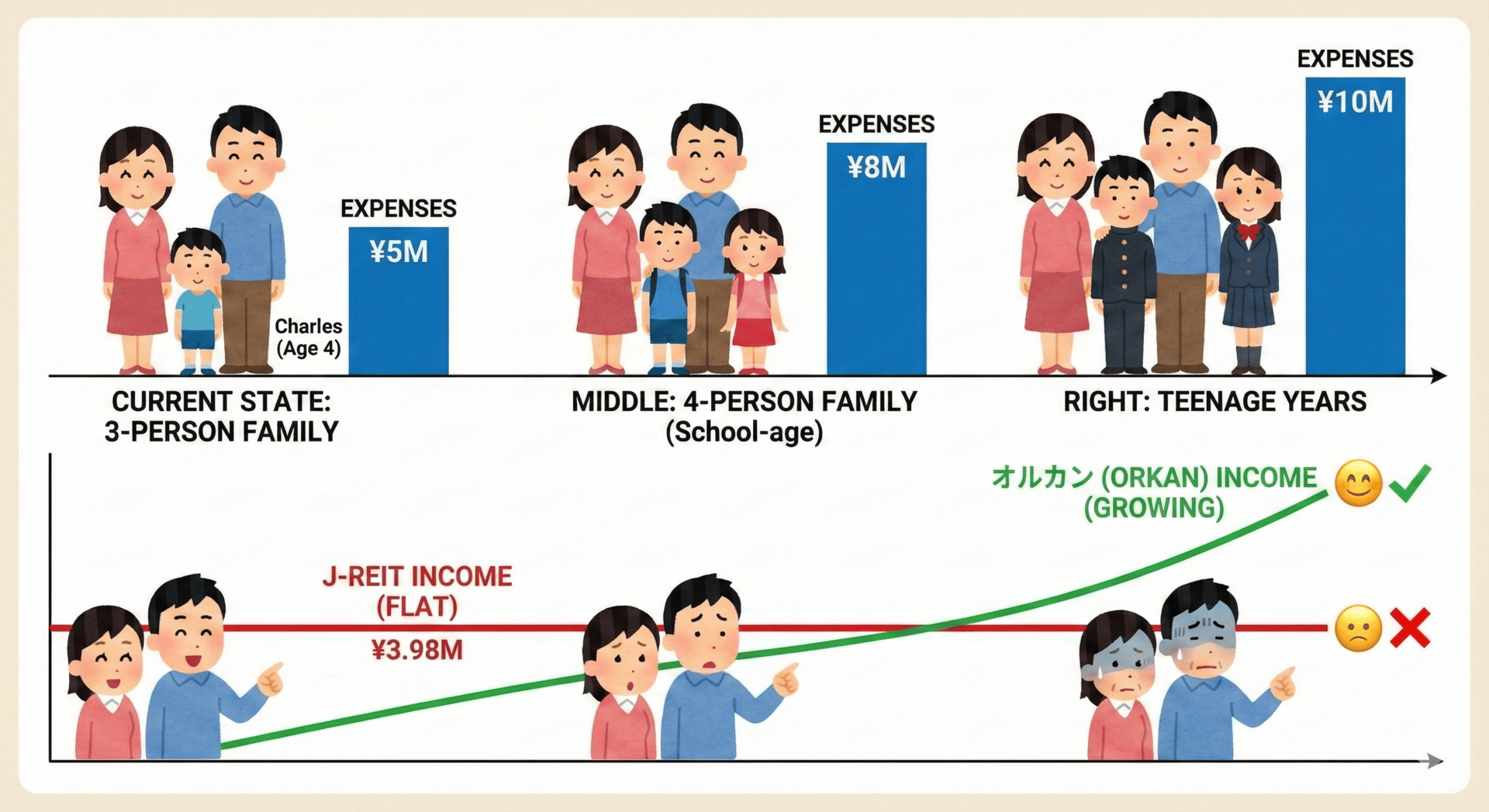

Here's why that matters for our family specifically.

Charles is four now. We're planning expenses around one child. But my wife and I have talked seriously about a second child in the next two to three years. If that happens, our family expenses don't just increase, they roughly double for education alone.

Current expenses (one child):

Annual spending: ¥5,000,000

Charles's international school: ¥2,500,000/year

Everything else: ¥2,500,000/year

Future expenses (two children, age 10 and 6):

Annual spending: ~¥8,000,000

Two international school tuitions: ¥5,000,000/year

Growing family expenses: ¥3,000,000/year

By the time Charles is 14 and his sibling is 10, we could easily need ¥8 million to ¥10 million per year just to maintain our current lifestyle. My オルカン portfolio can grow to support that through capital appreciation. Tanaka-san's J-REIT portfolio pays ¥3.98 million net after tax every year. Forever. Fixed.

When your expenses grow but your income doesn't, you have three options: cut lifestyle, return to work, or burn through principal. None of those sound like FIRE to me.

The third hidden cost became visible on December 20, 2022. I remember the date because I was checking financial news during my lunch break when I saw the headline: BOJ widens yield band. Effective rate hike.

The J-REIT fell more than 5% that day. In a single day. Not because of property fundamentals or occupancy rates. Because the Bank of Japan tweaked their yield curve control policy.

J-REITs are extremely sensitive to interest rates. When rates rise, two things happen simultaneously. First, J-REITs' borrowing costs increase since they use leverage to buy properties. Second, the relative attractiveness of their yields decreases compared to newly available higher-yield bonds. Both pressures push prices down.

We've now seen this pattern repeatedly as the BOJ normalizes policy. March 2024, they ended negative rates and stopped buying J-REIT ETFs after eight years of support. July 2024, rates went to 0.25%. December 2024, rates hit 0.75%, the highest level since 1995.

Every single move triggered J-REIT volatility. And this normalization isn't finished. The market expects the BOJ to continue gradually raising rates toward 1% or higher as inflation persists.

Meanwhile, my オルカン portfolio holds global equities. About 60% US stocks, 40% international. Only a tiny slice is Japanese real estate. When the BOJ raises rates, my portfolio feels it through the Japan allocation, but that's less than 5% of total holdings. The other 95% is diversified across economies with completely different monetary policies.

Tanaka-san's portfolio is 100% exposed to BOJ policy decisions. One surprise announcement, one faster-than-expected rate hike, and his portfolio could drop 5% to 10% in a matter of days. At ¥100 million, that's ¥5 million to ¥10 million in sudden losses.

My wife asked me the obvious question when I explained this. "Does Tanaka-san know about the interest rate risk?"

I suspect he does, intellectually. But I think he's betting the BOJ moves slowly and property fundamentals stay strong. Tokyo office vacancy is down to 3.5%. Grade A rents are up. Foreign investment is pouring in. The near-term picture looks good.

But FIRE isn't a 3-year bet. It's a 30-year bet. And I've seen enough economic history to know that central bank policy cycles are long and brutal. The BOJ spent eight years buying J-REIT ETFs and keeping rates at zero. They're now spending the next several years unwinding that support and normalizing rates. J-REIT investors are sailing into a headwind that could last the entire first decade of my retirement.

The Already-Have-It Reality

When I finished explaining all three hidden costs to my wife, she asked the question that made me realize I'd been overthinking this whole time.

"Don't you already have real estate in your portfolio?"

I pulled up the MSCI ACWI index composition. The benchmark that eMAXIS Slim All Country tracks. Real estate sector: roughly 3% of the index. Global REITs are already included.

I'm already holding real estate exposure. Not concentrated Japanese real estate betting on Tokyo office demand and BOJ policy. Global real estate across US industrial properties, European residential, Asian logistics, data centers worldwide. Diversified. Professionally managed. Automatically rebalanced.

The 5% J-REIT yield that Tanaka-san loves isn't giving him something I'm missing. It's giving him concentrated exposure to something I already own in the right dose as part of a diversified portfolio.

When you frame it that way, the question isn't "Why don't you hold J-REITs?" The question is "Why would you overweight Japanese real estate to 100% of your portfolio when you could hold 3% global real estate plus 97% other growth assets?"

What I Told Tanaka-san

I texted him back around midnight. Kept it simple.

"Your ¥100M gets you ¥3.98M after tax. My ¥143M gets me ¥5M with better tax efficiency via 定期売却. Plus オルカン can grow to support ¥8M or ¥10M when we have two kids. J-REIT income stays flat. I need growth, not just yield."

He replied the next morning. "Fair. Different strategies for different goals. I don't plan on kids."

That's the thing. Tanaka-san's J-REIT strategy isn't wrong for him. He's single, mid-forties, expenses are stable around ¥3 million per year. He likes seeing monthly deposits. The tax drag bothers him less than the psychological comfort of visible income. And frankly, if the BOJ craters J-REITs with rate hikes, he can just work another few years. He's not burned out.

But for our family, with Charles and potentially a second child, with expenses that will grow as kids age, with a 40-year retirement horizon ahead of us, I need a portfolio that grows. The ¥43 million "shortcut" that J-REITs offer isn't actually a shortcut. It's a ceiling that would force us back to work in our fifties when our kids are teenagers.

I'd rather invest the extra ¥43 million now in my early forties while I'm still earning well, and have the freedom to scale our lifestyle up if we want to, than lock into fixed income that can't grow with our family.

📋 This Week's Actions

If you're evaluating J-REITs for your own FIRE strategy, here's how to think through the decision:

Project 20-year family expenses: Write down your current annual spending. Add planned family expansion (kids, aging parents who might need support, lifestyle inflation). Ask honestly: will my expenses stay flat or grow? If they'll grow, you need portfolio growth, not just yield.

The 10-Year Vision

By 2035, Charles will be 14. If we have a second child in the next few years, they'll be 10. Two kids in international school. Music lessons. Sports. Family trips back to Europe to see grandparents. Our annual expenses could easily be ¥10 million or more.

The ¥100 million J-REIT portfolio would still be paying out ¥3.98 million per year after tax. We'd face an annual ¥6 million shortfall. That would force us back into the workforce or into drastic lifestyle cuts right when our kids are teenagers and family time matters most.

The ¥143 million オルカン portfolio, growing at historical equity rates, would be worth roughly ¥270 million. A 3.5% withdrawal from that base is ¥9.4 million per year. Enough to cover two kids in school, maintain our lifestyle, and still let the portfolio grow.

That's the difference between FIRE that lasts and FIRE that requires a retreat. Between raising our family with the freedom we've planned for and scrambling to patch together income in our fifties.

Tanaka-san's 5% yield looks attractive today. But I'm not optimizing for today. I'm optimizing for the decade when Charles brings friends home from school, when her sibling needs their own laptop, when we want to take the whole family to Hokkaido for a week without checking the budget three times first.

That future needs growth. Not just yield.

Stay Wealthy

Jason

Building wealth for English-speaking permanent residents in Japan, one story at a time.