My colleague Tanaka-san and I were walking back from lunch last week when she mentioned something that stopped me mid-stride. Her team was discussing their NISA accounts in the break room, comparing their tax-free investment growth. She casually asked if I'd opened mine yet.

I hadn't. Honestly, I'd assumed it was one of those "Japanese citizen only" programs, like voting or certain government benefits. As a permanent resident, I figured I'd keep using my international brokerage and paying the taxes.

"You know you qualify, right?" she said, genuinely surprised. "Foreign residents have the same access we do. My team has three non-Japanese members all using it."

That evening, I did the math that's been haunting me. Over the past three years, I'd paid ¥487,350 in taxes on my investment gains - 20.315% on every yen of profit. Tanaka-san? She paid zero on equivalent gains.

That's when I started researching seriously. With a long time horizon, every percentage point matters. What I discovered wasn't just a tax break - it was Japan's systematic approach to shifting an entire culture from savers to investors.

And as a foreign resident planning long-term in Japan, I had identical access to every benefit.

What NISA Actually Is: Japan's Cultural Transformation Tool

NISA stands for Nippon Individual Savings Account, but understanding what it really is requires understanding Japan's demographic crisis and the cultural shift the government is desperately trying to engineer.

The Problem Japan Is Solving

Japan has the world's highest savings rate but one of the lowest investment rates among developed nations. The typical Japanese household keeps 54% of assets in cash - mostly sitting in bank accounts earning 0.02% interest while inflation slowly erodes purchasing power.

This was sustainable when Japan had a growing working population. But with the world's fastest-aging society and declining birth rate, the math broke. Traditional pension systems can't support the demographic pyramid flip happening over the next 30 years.

The government's solution: Shift the culture from savings to investment through massive tax incentives. Make long-term investing so attractive that even risk-averse savers reconsider.

That's what NISA is - a social engineering tool disguised as a tax benefit.

How NISA Works

Think of it like the UK's ISA or a more flexible version of America's Roth IRA, but specifically designed to transform Japan's entire financial culture.

The core mechanism:

- You invest with after-tax yen (money you've already paid income tax on)

- Everything you earn grows completely tax-free forever

- When you withdraw, you pay zero tax - no matter how much you've gained

- No time limit on how long you can hold investments

- No mandatory withdrawals at retirement age

What you avoid: Japan's standard 20.315% tax on investment gains and dividends.

Let me show you what this means with real numbers:

The Five-Year Tax-Free Advantage

Year 1 investment: ¥3,600,000

Annual growth at 7%: ¥252,000 (year 1)

Total after 5 years: ¥20,700,000

Your contributions: ¥18,000,000

Your gains: ¥2,700,000

Tax without NISA: ¥548,505

Tax with NISA: ¥0

You keep: An extra ¥548,505 in your pocket

That ¥548,505 difference represents three months of Lily's international school tuition - earned simply by using the right account structure.

Over 20 years, the same systematic approach:

Annual investment: ¥3,600,000

Total contributions: ¥18,000,000 (capped at ¥18M, then stops)

Growth at 7%: ¥39,119,293 in gains

Account value: ¥57,000,000

Tax without NISA: ¥7,947,084

Tax with NISA: ¥0

Family wealth impact: ¥8 million more for Lily's education, our housing, retirement

Important Disclaimer:

This newsletter provides educational information based on personal research and experience. It is not financial advice, investment advice, or tax advice. All investment decisions should be made in consultation with licensed financial professionals familiar with your specific situation.

NISA regulations, tax treatment, and broker policies may change. Investment values can fluctuate. Past performance doesn't predict future results. Verify current rules before making investment decisions.

The 2024 Revolution: Permanent Tax-Free Status

January 2024 brought the most significant NISA reform in the program's history. The government essentially said: "We're serious about this cultural shift now."

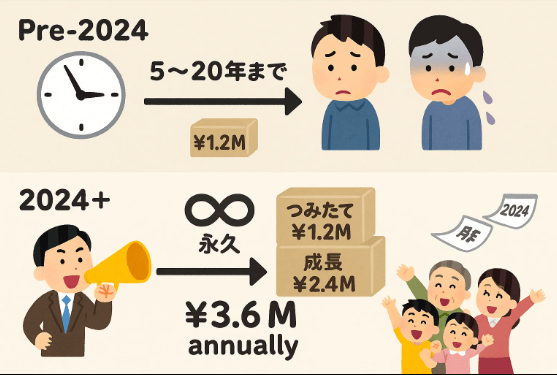

Old System (Pre-2024) - The Cautious Experiment:

- Choose one account type only (couldn't use both)

- Maximum ¥1.2 million per year contribution

- Tax-free period expired after 5-20 years (forced to sell or pay tax on future gains)

- Total lifetime cap: ¥6 million

New System (2024+) - The Aggressive Push:

- Use both account sections simultaneously

- Maximum ¥3.6 million per year (¥300,000 monthly)

- ¥18 million lifetime cap (3x the old limit)

- Tax-free status is permanent - no expiration ever

- No forced withdrawals at any age

What changed strategically: The government removed the artificial time limits that made NISA feel like a promotional offer. This is now structured as a permanent wealth-building tool designed to compete with traditional Japanese savings culture.

The Two-Section System

The new structure has two complementary sections you can use together:

Tsumitate Section (つみたて投資枠) - The Systematic Builder:

- ¥1.2 million per year (¥100,000 monthly)

- Pre-approved low-cost mutual funds only

- Designed for automatic monthly investing

- Perfect for systematic, long-term wealth building

- Lower volatility options available

Growth Section (成長投資枠) - The Flexible Tool:

- ¥2.4 million per year (¥200,000 monthly)

- Individual stocks, ETFs, REITs, and mutual funds

- Flexible investment timing

- For lump sum contributions or opportunistic purchases

- Higher risk/return options available

Combined power: ¥3.6 million annually, building systematically toward your ¥18 million lifetime cap.

The genius of this design: You can automate the Tsumitate section for consistent long-term growth while using the Growth section for lump sums from bonuses, inheritance, or accumulated savings.

The Foreign Resident Reality: What You Must Know

Here's the critical information that most foreign residents don't realize: You have identical NISA access to Japanese citizens. Same benefits, same contribution limits, same tax treatment, same investment options.

But there's one fundamental limitation that changes your entire strategic calculation.

The Departure Requirement

When you permanently leave Japan and lose tax residency, you must liquidate your entire NISA account.

This isn't negotiable. Unlike iDeCo (which you can maintain from abroad with restrictions), NISA completely disappears when you cease being a Japanese tax resident.

What this means for your planning horizon:

Staying 2 years: NISA probably doesn't make sense. The transaction costs and potential forced selling during a market downturn outweigh two years of tax savings.

Staying 5-7 years: The math starts working. ¥548,505 in tax savings over five years justifies accepting the departure risk, assuming you can de-risk your portfolio as departure approaches.

Staying 10+ years or permanent resident: NISA becomes a no-brainer. The multi-million yen tax advantage over a decade far outweighs departure risks, especially if you're committed long-term.

Career mobility unknown: You need to think hard about your realistic Japan timeline. If there's a 50%+ chance you'll leave within 3 years, the forced liquidation risk might outweigh the tax benefits.

My Personal Calculation

I'm approaching this as someone planning long-term in Japan with Lily in school here , but I'm maintaining international career optionality. For me, the 7-10 year minimum horizon makes the tax benefits worth accepting the forced liquidation risk.

If our situation changed and we needed to leave, I'd implement a systematic 6-12 month de-risking strategy but that is for a later post

Your calculation will differ based on your visa status, career trajectory, family situation, and honest assessment of your Japan commitment timeline.

The Family Wealth Perspective: Why This Matters to Us

Every financial decision I make now filters through one question: Does this help build the future I want for my family in Japan?

NISA fits that framework perfectly, and here's why it's become central to our family financial planning:

Lily's Education Security

International school in Tokyo costs ¥2.8 million annually. Over 13 years (K-12), that's ¥36.4 million before university.

The ¥8 million in tax savings from maximizing NISA over 20 years represents 20% of her total education costs - funded entirely by using the correct account structure rather than paying unnecessary taxes.

Put another way: By making one smart choice today (NISA vs taxable account), we're covering Grades 1-3 of Lily's education through tax savings alone.

Retirement Security in a Foreign Country

As foreign residents planning long-term in Japan, our retirement situation is more complex than Japanese nationals:

- No access to full Japanese state pension

- May not qualify for home country pensions depending on years abroad

- Healthcare coverage requires planning across potential countries

- Need larger emergency funds due to cross-border complexity

NISA's ¥18 million tax-free capacity represents a foundational retirement pillar that:

- Grows completely tax-free regardless of how large it gets

- Can be withdrawn flexibly if we need to relocate unexpectedly

- Doesn't have the age restrictions of iDeCo

- Compounds over decades into significant wealth

The Honest Trade-Off

The limitation I'm accepting consciously: If we leave Japan permanently before Lily finishes school, I'll need to liquidate during whatever market conditions exist at that time.

That risk is real. But the alternative - paying 20.315% tax on investment gains for the next 10-15 years - costs more in expected value than the departure risk, especially if I implement a systematic de-risking strategy as any departure approaches.

For our family, NISA has become the foundation of our Japan-based financial planning: education funding, housing flexibility, and retirement security - all built tax-efficiently within one account structure.

How to Actually Invest: The Simple System

When I first opened my NISA account, I faced 180+ approved mutual funds, hundreds of ETFs, and thousands of individual stocks. The paralysis was real.

Here's the systematic approach that cut through the noise:

For the Tsumitate Section: The One-Fund Solution in the style of “the simple path to wealth”

Global Equity Index Fund, in Japan the most popular is the

eMAXIS Slim All Country (オール・カントリー)

- Tracks MSCI All Country World Index

- Approximately 3,000 stocks across 47 countries

- Expense ratio: 0.05% annually (extraordinarily low)

- Automatic dividend reinvestment

- Automatic rebalancing as markets shift

- Complete global diversification in a single fund

Why this works: You get instant worldwide diversification covering developed and emerging markets, automatic rebalancing as different countries grow or shrink, and the lowest costs in the category. No need to pick between markets, sectors, or individual stocks. No manual rebalancing ever required.

The systematic approach:

1. Set up automatic monthly purchase of 10% of your income or however much you’re comfortable to set aside now

2. Link to your Japanese bank account for auto-withdrawal

3. Never touch it

4. Check account quarterly at most (monthly checking creates anxiety without improving results)

5. Let it compound for decades

That's the entire system. Seriously.

Alternative if you prefer US market focus: eMAXIS Slim S&P 500 gives you pure US market exposure (500 largest US companies) with similar ultra-low costs (0.09%).

My approach: I'm keeping it extremely simple: 100% eMAXIS Slim All Country across both sections, maxing the ¥3.6 million annual limit.

Why? Because complexity doesn't improve returns for index investors - it just increases the chances of mistakes, emotional decisions, and unnecessary monitoring time.

In Japan, this philosophy is called 仕組み化 (shikumika) - systematization. Building wealth through automated systems rather than constant decision-making.

Mistake #1: Overcomplicating the Strategy

I almost fell into this trap: buying six different funds that all tracked similar global indexes with 85%+ overlap. I would have paid 6x the fees for identical exposure.

The fix: For most people, one globally diversified fund gives you everything. Adding more funds doesn't improve diversification - it just creates the illusion of sophistication while increasing costs and complexity.

Mistake #2: Language Barrier Paralysis

"Everything's in Japanese, so I'll figure it out later."

Two years pass. You have not set anything aside for investing.

The fix:

- Get help for initial setup (Japanese-speaking friend, financial advisor, online community) I am happy to also have a call

- Use browser translation for ongoing research (Chrome auto-translates brokerage sites reasonably well)

- Join English-speaking communities: RetireJapan forum, r/JapanFinance subreddit

- Remember: Imperfect action beats perfect inaction

The setup takes 2-3 hours of focused effort. The tax savings compound for decades.

The Bigger Picture: Your Family's Financial Foundation in Japan

That conversation with Tanaka-san walking back from lunch fundamentally shifted how I think about building wealth for my family in Japan.

Before: International brokerage, paying 20.315% on every gain, no systematic approach, anxiety about whether I was doing this right

After: Tax-free NISA system, automated monthly investments, clear ¥18 million tax-advantaged path, systematic approach that works while I focus on family

The transformation wasn't complicated:

- One broker account

- One mutual fund

- One automatic monthly transfer (¥300,000)

- One commitment to long-term systematic investing

- Zero ongoing decisions required

What This Means for Your Family Over Time

In 5 years: ¥549,045 in tax savings — three months of international school tuition

In 10 years: ¥2.2 million in tax savings — most of a house down payment contribution

In 15 years: ¥4.6 million in tax savings — Lily’s university education largely funded

In 20 years: ¥7.9 million in tax savings — foundational retirement security

These aren't hypothetical numbers. This is the mathematical reality of tax-free compound growth versus paying 20.315% taxes annually on the same investments.

The only requirement: Start the system and let it run.

The next step is yours.

Your future self - the one 10 years from now with hundreds of thousands of yen in tax savings - will thank you for starting today.

Stay Wealthy

Jason

Building wealth for English-speaking permanent residents in Japan, one story at a time.