Table of Contents

Remember June 2019 when Japan erupted in anger over the Financial Services Agency report? The government said retirees need ¥20 million in addition to their pension. People were furious because the math seemed impossible.

The public outrage came down to one devastating calculation that spread across social media and news coverage:

Saving ¥10,000/month for 40 years:

¥10,000 × 12 months × 40 years = ¥4,800,000

Gap to ¥20M target: -¥15,200,000

Conclusion: Impossible for ordinary people

To actually save ¥20 million requires ¥41,667 per month for 40 years. Most Japanese workers couldn't dream of saving that much. The government was accused of abandoning citizens to an impossible retirement standard while pensions eroded.

But here's what shocked me when I started planning for our family's future: everyone calculated SAVING, not INVESTING. They forgot about compound interest completely. When I ran the numbers with Lily's education costs in mind, I discovered something that should have been headline news:

That ¥10,000 monthly contribution everyone said was worthless? Through compound interest at 7% returns, it doesn't just reach ¥20 million - it exceeds ¥26 million by retirement age. The goal Japan thought was impossible is not only achievable, it's exceeded by ¥6 million with the same modest contribution everyone was already discussing.

Want to go through your numbers for free? book a chat and I’d love to see if I can help you!

📧 Or email me: [email protected]

The Magic of Starting at 22 - And Crossing ¥20M

The 2019 controversy revealed something fascinating about how we think about money: our brains naturally calculate in straight lines, not curves. When someone says "save for 40 years," we multiply. When compound interest is involved, we need exponential thinking.

Let me show you what happens when you invest ¥10,000 per month starting at age 22, using the same 40-year timeline from the original controversy: (assuming 7% returns)

The Journey to ¥20 Million (and Beyond):

At age | 32 (10 years invested): | 42 (20 years invested) | 52 (30 years invested) | 58 (36 years invested) | At age 65 (43 years invested) |

|---|---|---|---|---|---|

Total contributions: | ¥1,200,000 | ¥2,400,000 | ¥3,600,000 | ¥4,320,000 | ¥5,160,000 |

Account balance: | ¥1,740,000 | ¥5,190,000 | ¥12,160,000 | 20,150,000 | 27,240,000 |

Progress to ¥20M: | 8.7% | 26% | 60.8% | ¥20M CROSSED | ¥6.2M MORE |

You cross the ¥20 million threshold at age 58 - seven years before retirement. The remaining seven years add another ¥7 million in growth. And remember: you only contributed ¥5.16 million total. Compound interest created the other ¥22 million.

Why ¥10,000/Month Is More Achievable Than 2019 Protestors Thought:

Here's what made the 2019 panic even more unnecessary: ¥10,000 per month represents only 2.6% of the average Japanese worker's monthly salary. According to 2024 wage data, the average annual salary in Japan is ¥4.58 million, which translates to ¥382,000 per month.

Average Japanese Monthly Salary: ¥382,000

¥10,000 investment: 2.6% of monthly income

Remaining for living: ¥372,000 (97.4%)

For younger workers just starting their careers (ages 22-25), the average monthly salary ranges from ¥250,000 to ¥300,000. Even at the lower end, ¥10,000 represents only 3-4% of monthly income - hardly the "impossible" burden the 2019 headlines suggested.

This means most ordinary Japanese workers can achieve the ¥20 million retirement target by setting aside less than 3% of their monthly salary. The outrage in 2019 wasn't because the goal was financially impossible - it was because nobody explained that investing small amounts early creates exponential growth through compound interest.

The Calculation They Missed in 2019:

Saving | Investing + Compound (7%) | |

|---|---|---|

Monthly Contribution | ¥10,000 | ¥10,000 |

Duration | 43 years (age 22-65) | 43 years (age 22-65) |

Total Contribution | 5,160,000 | 5,160,000 |

Final Balance | 5,160,000 | 27,240,000 |

Surplus over 20M Target | ¥7,240,000 |

Why you want to start early:

(assuming 10,000 contributed a month at 7%)

Starting Age | Years to Age 65 | Total Contributions | Final Balance | Crosses ¥20M? |

|---|---|---|---|---|

22 | 43 years | ¥5,160,000 | ¥27,240,000 | Yes (age 58) |

27 | 38 years | ¥4,560,000 | ¥19,850,000 | Just short |

32 | 33 years | ¥3,960,000 | ¥13,820,000 | No |

37 | 28 years | ¥3,360,000 | ¥9,180,000 | No |

Starting at age 27 instead of 22 - just five years later - means you fall ¥150,000 short of the ¥20 million target with the same ¥10,000 monthly contribution. To reach ¥20M starting at age 27 requires ¥10,085/month. Starting at 32 requires ¥14,475/month - nearly 50% more than if you started at 22.

The 15-Year Advantage - Even Late Starters Can Reach ¥20M

If you're reading this at age 30 or 35 thinking "I missed the window," you haven't. But you need to understand the acceleration pattern and adjust your contribution accordingly.

The Catch-Up Calculation:

To reach ¥20 million by age 65 starting late requires higher monthly contributions, but they're not as dramatic as you might fear:

Starting at 27 (38 years): ¥10,085/month needed

Starting at 32 (33 years): ¥14,475/month needed

Starting at 37 (28 years): ¥21,780/month needed

Starting at 42 (23 years): ¥33,450/month needed

Yes, starting at 37 requires more than double what a 22-year-old invests. But it's still achievable for many professionals in their late thirties with established careers. The key is starting immediately once you understand the math.

The Three-Stage Acceleration Pattern:

Compound interest doesn't work in a straight line. It accelerates dramatically in later years, but only if you build the foundation early. Here's what happens with ¥10,000/month:

Stage 1 - The Foundation (First 15 years, age 22-37):

- Contributions: ¥1,800,000

- Balance growth: ¥0 → ¥3,150,000

- Feels slow, contributions dominate returns

Stage 2 - The Multiplication (Second 15 years, age 37-52):

- Contributions: ¥1,800,000

- Balance growth: ¥3,150,000 → ¥12,160,000

- Returns start matching contributions

- Balance nearly quadruples

Stage 3 - The Explosion (Final 13 years, age 52-65):

- Contributions: ¥1,560,000

- Balance growth: ¥12,160,000 → ¥27,240,000

- Returns dominate contributions

- Final years create more wealth than first 30 years combined

The Late Starter Success Story:

Even if you start at 32, here's your path to ¥20 million:

Now of course, the math

Option 1 - Increase contributions:

¥14,475/month for 33 years = ¥20,013,000

Option 2 - Combination approach:

Start: ¥10,000/month (age 32-35)

Increase 5%/year (ages 35-40)

Stabilize: ¥13,000/month (ages 40-65)

Result: ¥20,400,000

Option 3 - Career growth strategy:

Start: ¥10,000/month (age 32-37)

Salary increase: Add ¥5,000/month (age 37-42)

Final: ¥20,000/month (age 42-65)

Result: ¥21,800,000

Now let’s say you’re starting at 50?

Try it yourself here!

The crucial insight from the 2019 controversy isn't just that ¥20 million is achievable starting at 22. It's that the target remains achievable at almost any age - if you invest rather than save, and if you start immediately rather than waiting another year.

Every year you delay makes the required monthly contribution steeper. At 32, you need ¥14,475/month. Wait until 33, and you need ¥15,150/month. That single year of delay costs you ¥675 more per month for the next 32 years - a total of ¥259,200 in additional required contributions.

Japan's Inflation Awakening - Why 0.2% Savings Won't Work

The 2019 retirement panic also revealed another assumption: people thought saving in the bank would at least preserve their money. In the deflation era, that was true. In 2025's inflation reality, it's devastating.

The Regular Savings Account Reality:

Most Japanese keep money in regular savings accounts earning approximately 0.2% interest. Term deposits can reach 0.43%, but they require locking money away and aren't accessible for most people's day-to-day savings strategy.

Let me show you what happens to ¥1 million over 20 years in a regular savings account:

Regular Savings Account (0.2% interest):

Starting amount: ¥1,000,000

After 20 years (nominal): ¥1,040,811

Inflation erosion (2.7% annual): -¥715,454

Real purchasing power: ¥325,357 equivalent

You've lost 67.5% of your money's value

That's not a theoretical worst-case scenario. That's the guaranteed mathematical result of keeping money in a typical bank account while inflation runs at 2.7%. Your million yen becomes worth ¥325,000 in today's purchasing power.

Even the "better" interest rate of 0.43% from term deposits still results in losing more than half your purchasing power. Neither regular savings (0.2%) nor term deposits (0.43%) come close to beating 2.7% inflation.

The Investment Alternative:

Investment Portfolio (7% return):

Starting amount: ¥1,000,000

After 20 years (nominal): ¥3,869,684

After inflation (2.7% annual): ¥2,323,251

Real purchasing power gained: +132%

Difference vs. regular savings: ¥1,997,894 more wealth

An Important Note About the ¥20 Million Target:

Here's something the 2019 FSA report tried to explain but got lost in the controversy: whether ¥20 million is actually sufficient for your retirement depends entirely on your individual spending habits and lifestyle.

The ¥20 million figure was an average estimate - a starting point for thinking about retirement, not a one-size-fits-all target. Some people will need significantly more than ¥20 million. If you plan to maintain a Tokyo lifestyle with international school costs for grandchildren's visits, extensive travel, or premium healthcare, ¥20 million might fall short of your needs.

Others might need considerably less than ¥20 million. If you've paid off your home, live in a rural area with lower costs, maintain modest spending habits, or have additional pension income, ¥15 million might provide a comfortable retirement.

Your Personal Target Depends On:

- Where you live (Tokyo vs. rural areas)

- Housing status (paid off vs. renting)

- Lifestyle expectations (travel, hobbies, entertainment)

- Family obligations (supporting children, elderly care)

- Health considerations (insurance, medical costs)

- Additional income sources (pensions, part-time work)

This is why these calculations are educational examples, not personalized financial advice. The compound interest math works regardless of your target - whether you need ¥15 million or ¥30 million, investing beats saving in an inflationary economy. But determining YOUR specific number requires looking at your actual spending patterns and retirement vision.

Breaking the Cultural Savings Habit:

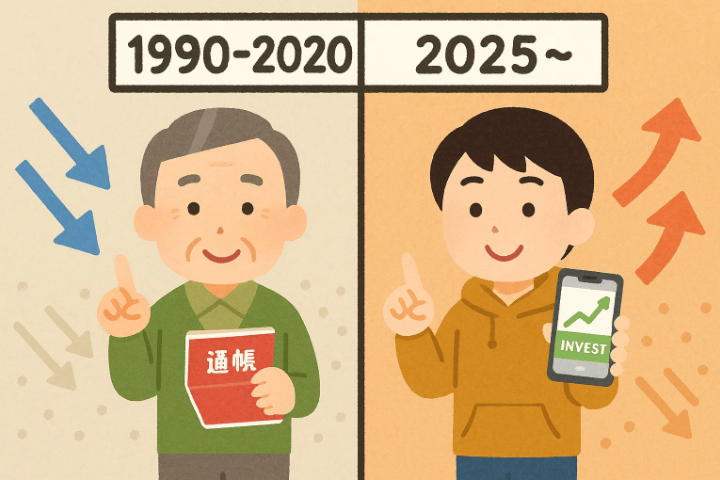

I understand why this feels wrong. For thirty years (1990-2020), Japanese people watched their parents succeed by keeping everything in the bank. Deflation meant cash naturally gained value. The stock market crashed in 1990 and spent decades recovering. Your parents were absolutely right to avoid investing - in their economic era.

But 2025 is fundamentally different:

Your Parents' Era (1990-2020): | Your Era (2025+): | |

|---|---|---|

Inflation | Negative to zero | 2.7%+ |

Bank Interest | Often exceeded inflation | 0.2% regular, 0.43% term deposits |

Stock Market | Recovering from bubble crash | Global diversification available |

Correct Strategy | Keep cash in bank | Invest for growth |

The 2019 panic over ¥20 million retirement needs happened during the transition between these two economic eras. People were still thinking in terms of saving (their parents' strategy) rather than investing (the strategy required for the new inflation reality).

Young Japanese investors are waking up to this shift. Investment adoption among people in their twenties jumped from 13% in 2016 to 36% in 2024. The new NISA system launched in January 2024 saw ¥7.5 trillion invested in the first six months alone - four times higher than the same period in 2023.

Want Help With YOUR Numbers?

Let's Calculate Your Personal Retirement Target

The ¥20 million controversy taught us something important: general targets are useful starting points, but your specific retirement needs depend on your unique spending habits, lifestyle goals, and family situation.

Maybe you're wondering:

- Is ¥10,000/month enough for MY situation, or should I invest more?

- What's my realistic retirement target based on my actual spending patterns?

- How do I balance retirement investing with Lily's education fund and our emergency savings?

- Should I use NISA, iDeCo, or both given my income and tax situation?

I'd be genuinely happy to walk through your specific numbers together. No sales pitch, no obligation - just a conversation about making compound interest work for your family's unique goals.

📅 Book a 30-minute consultation:

📧 Or email me: [email protected]

Think of it as the coffee table conversation we'd have if we were neighbors - except I'll bring the napkin math that shows exactly how the numbers work for you.

免責事項 | Disclaimer

This newsletter provides educational information about personal finance and investing in Japan. It does not constitute professional financial advice. Investment returns are not guaranteed; past performance doesn't predict future results. The 7% return assumption reflects historical market averages but actual returns vary. Consult a licensed financial advisor before making investment decisions. The ¥20 million retirement target discussed reflects the 2019 FSA report average and may not suit your individual needs.

Stay Wealthy

Jason

Building wealth for English-speaking permanent residents in Japan, one story at a time.