Table of Contents

A colleague asked me in the company cafeteria last month: "How do you figure out if you should stay and negotiate, or start looking for another job?"

He'd just gotten his annual review. Top marks. His manager said he was "essential to the team." The raise? 4.8%. He'd done the same math I once did: at that rate, by the time he could afford what he wanted for his family, his kids would be grown.

I told him what my wife asked me three years ago at our kitchen table, late one Tuesday night after Lily was asleep. We had international school tuition breakdowns from three schools spread between us. Roughly ¥3 million per year. She looked at my salary projections with 5% annual raises and said: "Can we actually afford this with your current trajectory?"

I ran the numbers again. Starting at ¥5 million with consistent 5% raises, I'd reach ¥6.08 million after four years. With the trajectory I was on, Lily would be in university before I could afford her elementary school tuition. The math didn't add up. I wasn't playing the wrong game. I was playing the right game with the wrong strategy.

That realization led me to change companies four times in four years. I doubled my salary. Not 2%, not 5%. One hundred percent increase. It made a significant difference to our lifestyle and what became possible for our family.

My colleague wanted to know: How do you know which path to take?

Know the Rules of YOUR Game

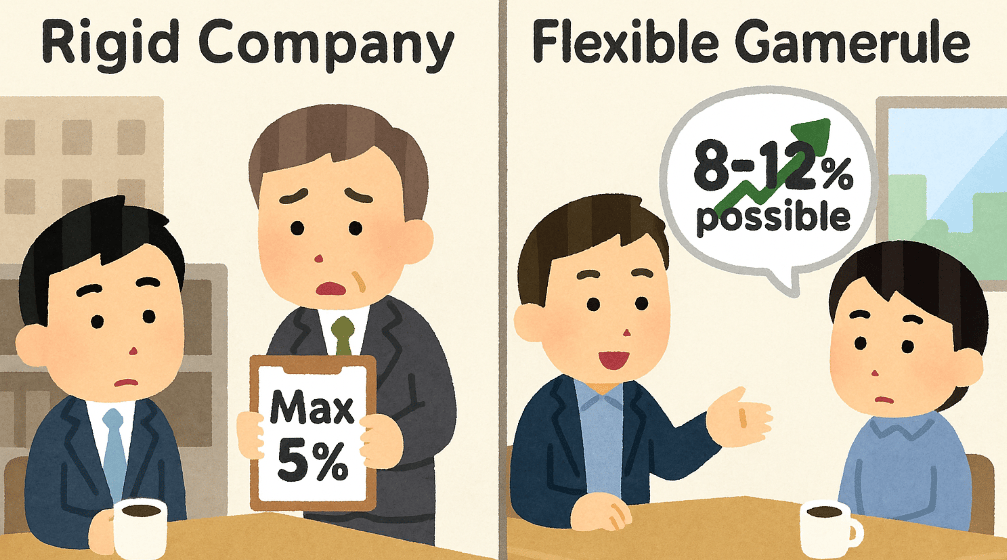

Here's what most salary advice gets wrong: it assumes everyone's playing the same game. In Japan in 2025, you're not. Your company has a specific raise ceiling, and you need to know what it is before you decide your strategy.

Some companies run strict assessment structures where even top performers max out at 5% annual increases. The budget gets set in January or February, and your manager has limited flexibility regardless of your performance. Other companies allow genuine negotiation where strong performers can secure 8%, 10%, or higher raises through manager discussions. The difference between these two scenarios changes your entire approach.

I worked at both types. At one company, my manager told me directly: "You're rated exceptional, but our structure caps exceptional performers at 5.28%. I can't change it." At another, I negotiated 12% by demonstrating market research and showing my impact with specific metrics. Same effort, different rules, completely different outcomes.

The 2025 Shunto results showed average wage increases of 5.46%, the highest in 34 years. Large firms averaged 5.28%, small and medium enterprises hit 5.09%. These are real improvements in Japan's wage landscape. But averages hide the reality: your specific company has its own ceiling, and that number determines whether internal negotiation can get you where you need to go.

Here's the framework I wish someone had shared with me earlier: Know the rules of YOUR game.

Define Your Target and the Tradeoffs

You need a specific number and a specific reason. Not "I want to earn more." That's too abstract. What benefit becomes possible when you hit a certain salary level? What does that enable for your family?

For me, it was +¥3 million per year for Lily's international school tuition. That was the target. Achieving it meant she could have quality English education while maintaining cultural connections. Missing it meant different choices for her education and our family's future.

But targets come with tradeoffs. I know lawyers and consultants earning ¥15 to ¥20 million who miss their kids' birthdays regularly. They hit their salary targets and pay a different price. What matters to YOUR family? That's the question you need to answer together, not alone.

My wife and I talked through the risks: changing jobs means visa considerations, potential mortgage complications, starting over at new companies, losing accumulated tenure benefits. We decided the speed toward our goal justified those tradeoffs. Your calculation might be different. Some families optimize for stability over speed. Neither is wrong. But you need to know which game you're playing and why.

The national average salary in Japan is ¥4.6 million. Tokyo professionals average closer to ¥10 million. If you're earning in the ¥4 to ¥10 million range and looking to increase, you have options. The framework works differently at ¥20 million and above. This advice primarily applies to full-time employees (正社員). Contract employees (契約社員) face different constraints around benefits and advancement that change the calculation.

Do the Math: Timeline to Target

This is where the decision becomes clear. Calculate how long it takes to reach your target with your company's raise structure. Then compare that timeline to your actual needs.

Here's my math from three years ago:

Starting salary: ¥5,000,000 Target salary: ¥10,000,000 (to comfortably afford ¥3M school + living expenses) With 5% annual raises: Year 1: ¥5,000,000 Year 2: ¥5,250,000 Year 3: ¥5,512,500 Year 4: ¥5,788,125 Year 5: ¥6,077,531 After 4 years: ¥6,077,531 (¥1.08M increase) Gap to target: -¥3,922,469 Time to reach ¥10M at 5% annual: Approximately 17 years

Lily was four years old. International elementary school starts at six. With 5% raises, I'd reach my target salary when she was 21. The timeline didn't match our needs.

Compare that to what actually happened through strategic job changes:

Job Change Strategy Results: Starting: ¥5,000,000 (Company A) After 1 year: ¥6,800,000 (Changed to Company B, +36%) After 2 years: ¥8,200,000 (Changed to Company C, +21%) After 3 years: ¥9,500,000 (Changed to Company D, +16%) After 4 years: ¥10,000,000 (Internal performance raise) Total increase: ¥5,000,000 (100%) Time to target: 4 years instead of 17 years

The math is stark: 17 years of 5% raises equals one strategic job change in terms of total salary increase. I'm not suggesting everyone should change jobs four times. I'm showing what the numbers look like when internal raises won't close your gap in time.

According to 2024 Ministry of Health, Labour and Welfare data, 40% of people who change jobs see salary increases. That means 60% see decreases or no change. It's not guaranteed. But when your timeline analysis shows the internal path won't work, the external strategy becomes the logical choice despite the risk.

Visa Awareness: Context, Not a Blocker

Before I talk about strategy, let's address visa considerations. This isn't a show-stopper, but it's something to be aware of when job searching.

If your visa is tied to your employer (most work visas), it doesn't immediately get revoked when you leave your job. Your visa remains valid as long as your activity type matches. But you have a three-month window to find new employment, and you must notify immigration within 14 days of changing employers. If you have a Highly Skilled Professional (HSP) visa, it IS tied to your specific employer and you'll need to reapply.

If you have permanent residency or a spouse visa, you can change jobs without restrictions. If you're on an employer-sponsored visa, plan your job search to have your new position lined up before leaving your current company. This is standard practice and removes the visa timeline pressure.

Don't let visa concerns paralyze you into staying in a role where the math doesn't work. Understand the requirements, plan accordingly, and factor it into your timeline. It's context for your risk assessment, not a reason to accept a trajectory that won't meet your family's needs.

My Number One Strategy: LinkedIn (10 Minutes Beats 2 Hours)

If you decide the external path makes sense, here's what worked for me: LinkedIn strategy. Not networking events. Not coffee meetings with every connection request. Content creation that works while you sleep.

I post three times per day on LinkedIn. Each post takes roughly 10 minutes. That's 30 minutes daily versus two-plus hours for generic networking events. The content? I share work I'm doing (respecting confidentiality), industry views I'm developing, and skills I'm learning in my current role.

Three of my last four jobs came through LinkedIn:

Meetups I organized for my product management role, shared on LinkedIn, recruiter saw my content

Direct recruiter outreach based on posts about industry trends I was analyzing

Direct contact from hiring manager: "We need a product manager, you seem to know what you're doing based on your posts"

Here's why this works in Tokyo specifically: the city is huge and everyone is busy. LinkedIn adoption in Japan is low overall (under 2.5% of the population), but it's significantly higher among foreign companies, tech firms, and international professionals. If you're an expat or working in tech/international business, you're in the segment where LinkedIn is highly effective.

The algorithm does the work. While I'm having dinner with my family or putting Lily to bed, my content reaches recruiters and hiring managers I'd never meet at networking events. When I do start actively job hunting, I have a warm reception. People already know my work, my thinking, my skills. Coffee meetings with every connection would be exponential effort. Content creation is linear time with exponential results.

The alternative platforms (Daijob, CareerCross, GaijinPot, Japan Dev) work well for active job searching. LinkedIn works for long-term positioning. I used both: LinkedIn for visibility and warm network, job boards for active applications. The combination created options.

The Results: What Actually Changed

I doubled my salary from my first company to where I am now. That's the clean summary. The messy reality involved four job changes, four rounds of visa paperwork, restarting at new companies, proving myself repeatedly, and mortgage complications because banks prefer employment stability.

Each change involved risk. At Company B, I worried I'd made a mistake in the first month when team dynamics were different than interviews suggested. At Company C, the role shifted unexpectedly and I had to adapt quickly. Not every change was smooth. But the math kept working: my salary increased, our timeline to afford Lily's international school compressed from impossible to achievable.

The tradeoff was instability for speed. Some families can't absorb that instability. If you're applying for a mortgage soon, banks typically want three to five years with the same employer. There's a RetireJapan forum discussion about Japanese bankers who jumped to Goldman Sachs for two to three times their salary, then got declined for mortgages because the bank viewed it as "less stable employment." That's a real consequence.

But if your timeline analysis shows the gap is too large and you're not in the middle of major financial commitments like mortgage applications, the external strategy can close the distance faster than internal negotiations. For our family, it made Lily's international school possible. That was worth the instability.

We're not living some luxury lifestyle. We made one thing possible: quality English education for our daughter while living in Tokyo. The salary increase bought us that specific option. It didn't solve every financial challenge. It solved the one we'd identified as our priority.

Action Steps: Your Framework This Week

📋 This Week's Actions:

Calculate your target: What specific financial goal do you need to achieve, and why? Write down the exact yen amount and the family benefit it enables. Be honest about the tradeoffs.

Research your ceiling: Ask HR or trusted colleagues about your company's actual raise structure. Is there flexibility, or is there a cap? This determines if internal negotiation can close your gap.

Run the timeline math: Starting from your current salary, calculate how many years to your target with your company's raise percentage. Compare that timeline to when you actually need to hit your goal.

Optimize LinkedIn now: Update your profile, start posting three times per day (work you're doing, industry insights, skills you're learning). Build visibility while you decide your strategy. Even if you stay, the network helps.

Track warm connections: When people comment or send connection requests, have brief coffee or video calls. Build genuine relationships. If you decide to pursue the external path, you'll have a warm network ready.

The decision isn't "should everyone job hop?" The decision is "does the math work with my current strategy?" If your company's raise ceiling gets you to your target within your timeline, optimize internally. Time your negotiation with the budget cycle (January to February), document your value with specific metrics, frame your impact around company needs.

If the ceiling won't get you there in time, the external path becomes the logical choice. Not emotional, mathematical.

The Long View: Ten Years from Now

Ten years from now, Lily will be a teenager. The international school decision we're making now shapes her education, her language abilities, her cultural connections, and her future opportunities. The salary decisions I made three years ago made that path possible.

This isn't about job-hopping for its own sake or chasing every salary increase. It's about understanding the rules of your specific game, doing the math on your actual timeline, and making the intentional choice that aligns with your family's priorities.

Some of you will run the numbers and realize internal negotiation works perfectly. Your company has the flexibility, your timeline matches, and stability serves your family better than risk. Optimize that path.

Others will run the same numbers and see the gap I saw: the trajectory won't get you there in time. If that's your reality, the external strategy isn't reckless. It's the systematic response to a mathematical problem.

The framework is simple: Define your target. Know your ceiling. Calculate the timeline. Choose your strategy based on what the math shows, not on what feels comfortable or what conventional wisdom suggests.

Your family's financial goals are specific to you. The rules of your company's compensation structure are specific to your employer. The only question that matters is: does your current path get you where you need to go in the time you have?

If yes, stay and optimize. If no, the path forward is clear.

For personalized financial guidance, please consult with qualified Japanese financial advisors who can assess your individual circumstances.

Stay Wealthy

Jason

Building wealth for English-speaking permanent residents in Japan, one story at a time.

P.S. I have recently started an instagram page with my wife, and so if interested come and check it out?!