A colleague cornered me in the company cafeteria last month with a question that's been rattling around my head ever since. "You turned down that traditional company offer, right? The one that paid ¥2M more?" He was staring at his own offer letter, clearly torn between a safe ¥10M role at a well-known manufacturing firm and a riskier ¥8M position at a fintech startup. "Was it worth it?"

I looked at him and realized: five years ago, I was sitting exactly where he is now. Same cafeteria, different table. Same agonizing decision. And back then, every fiber of my being screamed to take the higher salary. Lily was two, we were thinking about another child, and ¥2M felt like an ocean between financial security and recklessness.

But here's what I've learned the hard way: sometimes the most expensive decision you can make is choosing the bigger number.

The invisible script running through my head five years ago was pure Japanese workplace gospel: stability equals staying power equals seniority equals success. My father-in-law worked at Toyota for 38 years. One company. Steady promotions. Retirement allowance that funded a comfortable life. "Why would you risk that?" my wife asked when I first mentioned the fintech role.

Because I'd done the math that nobody talks about at family dinners. Not the obvious math—¥10M versus ¥8M times five years equals ¥10M opportunity cost. That math is easy and terrifying and makes you want to play it safe.

The harder math? The math that required me to think like an investor rather than an employee? That's what changed everything.

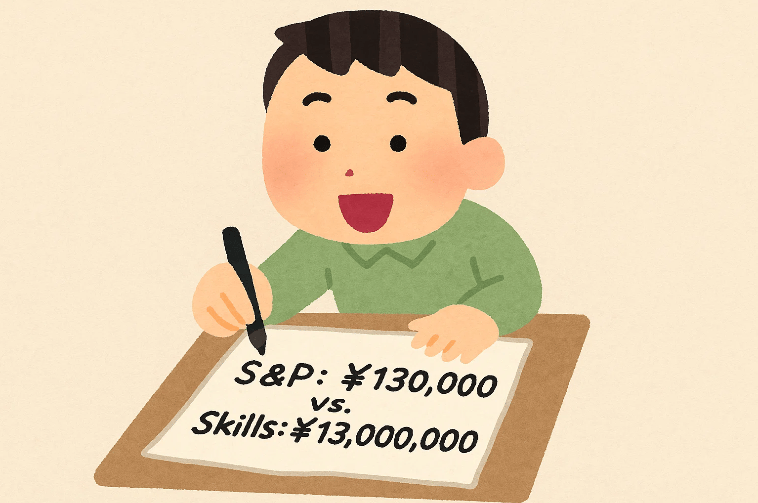

I discovered Alex Hormozi's S&Me 500 framework around that time, and it flipped my entire mental model. Here's the core insight that made me reconsider everything:

The Investment Choice

Option A: Invest ¥1,250,000 in S&P 500

Annual return at 10.43%: ¥130,000/year

Option B: Invest ¥1,250,000 in yourself (S&Me 500)

Potential earnings increase: ¥13,000,000/year

ROI Comparison: 100x difference

The framework is simple: you can earn 10% on what you've made, or you can 10x what you make. In Japan, where the average lifetime salary is ¥228.89M over 38 years, that difference compounds into generational wealth.

So I built what I call my Career Capital ROI Calculator. It's not fancy—I sketched the first version on a napkin at that same cafeteria—but it gave me a framework for thinking beyond year-one salary.

Here's how I broke down the decision:

Career Capital Components

(80,000 Hours framework):

Skills & Knowledge: What will I learn here that makes me more valuable?

Connections: Who will I work with and learn from?

Credentials: What does this role signal to future employers?

Character: How will this challenge develop my capabilities?

Savings: Can I still build financial runway while investing in growth?

For the traditional manufacturing role offering ¥10M, the answers were: incremental skills in a declining industry, mid-level manager connections, solid but generic credential, comfortable maintenance mode, decent savings rate.

For the fintech role at ¥8M? Product management skills in explosive demand (current PM range in Tokyo: ¥16-20M), direct access to C-suite and international network, startup experience increasingly valued, steep learning curve forcing rapid growth, tighter savings but manageable.

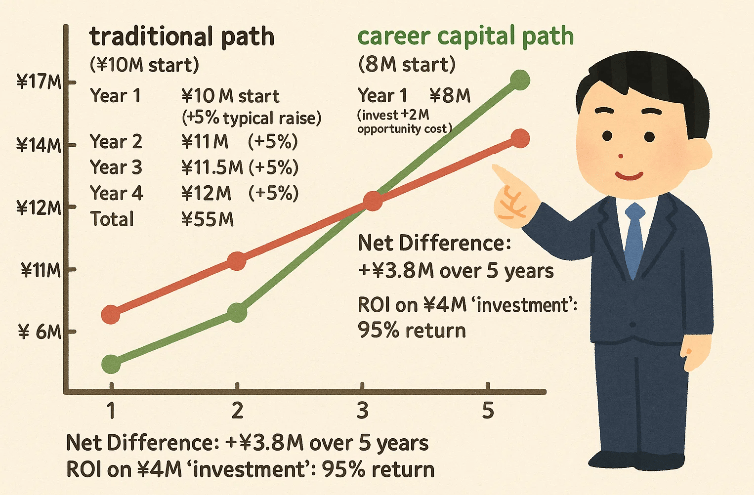

Then I calculated the five-year projection with real market data:

Five-Year Career Capital ROI

Traditional Path (¥10M start): | Career Capital Path (¥8M start): | |

|---|---|---|

Year 1: | ¥10M | ¥8M (invest ¥2M opportunity cost) |

Year 2: | ¥10.5M (+5% typical raise) | ¥8.8M (+10%, skill premium growing) |

Year 3: | ¥11M (+5%) | ¥11M (+25% job hop with PM experience) |

Year 4: | ¥11.5M (+5%) | ¥14M (+27% with fintech network) |

Year 5: | ¥12M (+5%) | ¥17M (+21% market rate for experienced PM) |

Total: | ¥55M | ¥58.8M |

Net Difference: +¥3.8M over 5 years = ROI on ¥4M "investment": 95% return

This wasn't theoretical. According to 2025 Japan job market data, 33% of job switchers are seeing 10%+ salary increases, and job mobility has increased 50% since 2019. The old script about staying at one company is breaking down, especially in tech and international firms.

But here's what the spreadsheet couldn't capture: the compounding effects I didn't see coming.

At the fintech company, I wasn't just learning product management. I was working directly with the CEO who'd scaled three companies. I was in rooms with venture capitalists discussing market strategy. I was building relationships with engineers who'd later start their own companies (two of them have since tried to hire me at ¥18M+).

That network effect? There's no formula for it, but research shows social capital directly increases salary, promotions, and career satisfaction. My connection to one particular industry leader led to a consulting opportunity that paid ¥3M for three months of part-time work. That single gig—impossible without the career capital I'd built—covered my entire two-year opportunity cost.

The skills compounded too. Product management at a fintech startup meant I was doing the work of three people at a traditional company: market analysis, user research, technical specification, stakeholder management. Every quarter felt like a year of learning. By year three, recruiters started calling with opportunities I would never have qualified for from the traditional path.

Here's the framework I wish someone had given me five years ago:

Career Capital Decision Matrix

Traditional: | Fintech: | |

|---|---|---|

Learning Rate (1-10): How fast will I develop valuable skills? | 4/10 (incremental) | 9/10 (exponential) |

Network Access (1-10): Quality of relationships I'll build? | 5/10 (mid-level managers) | 9/10 (C-suite, investors, entrepreneurs) |

Market Trajectory (1-10): Is this industry growing or declining? | 4/10 (manufacturing stabilizing) | 9/10 (explosive growth, 15% annual) |

Transferability (1-10): Can these skills port to other roles? | 6/10 (industry-specific) | 9/10 (PM skills highly transferable) |

Salary Growth Ceiling (realistic 5-year projection): | ¥12M | ¥17-20M |

Weighted Score: | 5.8/10 | 9.0/10 |

The math was clear once I looked beyond year one.

Last week, I finally told my colleague what I learned. He was still holding that offer letter, now crumpled from two weeks of anxious deliberation.

"Here's what nobody tells you about career decisions in Japan," I said. "We're taught to optimize for stability and seniority. But the data from 2025 tells a different story. Average wage growth hit 5.46%—the highest since 1991. Job hoppers are getting 10%+ raises. The market is rewarding skills and mobility, not just tenure."

I showed him my napkin framework—now digital, but still simple. "Calculate your five-year trajectory, not your year-one salary. Factor in learning rate, network access, and market trajectory. Then ask yourself: which path builds more career capital?"

He took the fintech role.

And I? I'm now in year five of my journey. Current salary: ¥16.5M. Recent offer from a former colleague's startup: ¥19M. Total earnings over five years: ¥58.8M, compared to the ¥55M I would have made on the "safe" path.

But here's what matters more than the ¥3.8M difference: I'm building something that compounds for Lily's entire childhood. Every skill I develop, every relationship I nurture, every credential I earn—these aren't just career assets. They're family assets.

The Long-Term Family Impact

Career Capital Investment (5 years):

"Lost" salary years 1-2: ¥4M

Additional earnings years 3-5: ¥7.8M

Net gain: +¥3.8M

But the real compounding:

Current market value: ¥19M (vs ¥12M traditional path)

Annual difference: ¥7M

Over next 10 years at conservative growth:

Traditional path total: ¥140M

Career capital path total: ¥200M

Difference: ¥60M

That ¥60M means:

- Lily's international school: Fully funded

- NISA max contributions: ¥18M/year instead of ¥12M

- Retirement at 55: Possible instead of 65

- Family's financial freedom: Decades earlier

When Lily asks me someday why I work where I work, I won't tell her about the salary. I'll tell her about the decision I made when she was two years old—the decision to invest in the person I was becoming rather than protect the salary I was earning.

Because here's what I've learned: in Japan's evolving employment landscape, the riskiest choice isn't taking the lower salary to build career capital. The riskiest choice is optimizing for year-one comfort and waking up a decade later realizing you left millions—and possibilities—on the table.

The framework is simple. The execution requires courage. But your future self will thank you for thinking beyond the immediate number on the offer letter.

Your move.

Further Resources:

If you're evaluating a career decision right now, here are the tools that helped me quantify the unquantifiable.

80,000 Hours Career Guide (80000hours.org/career-guide) provides the most comprehensive framework for evaluating career capital—their five-component model (skills, connections, credentials, character, savings) is what I used to build my decision matrix.

Morgan McKinley Fintech Japan Salary Survey 2025 (Salary-Guide) gives you real market data for your industry so you're negotiating from evidence, not hope. And if you want to dive deeper into the psychology of why we make short-term financial decisions that hurt us long-term,

Ramit Sethi's Invisible Scripts framework (iwillteachyoutoberich.com/money-scripts) will help you identify the cultural and family beliefs that might be sabotaging your career capital thinking.

【免責事項 / Disclaimer】 本コンテンツは教育・情報提供のみを目的としており、投資助言ではありません。投資判断はご自身の責任で行ってください。過去の実績は将来を保証しません。 This content is for educational purposes only and does not constitute investment advice. Investment decisions are made at your own risk. Past performance does not guarantee future results. For personalized financial guidance, please consult with qualified Japanese financial advisors who can assess your individual circumstances.

Stay Wealthy

Jason

Building wealth for English-speaking permanent residents in Japan, one story at a time.