The gentle afternoon sunlight streams through our Takatsu-ku home's windows as I write this, watching my daughter Lily peacefully nap. These quiet moments often lead to deep reflection about our family's future, and today, I found myself reviewing our NISA investment strategy – a cornerstone of our family's financial foundation.

I've noticed a fascinating pattern in my recent conversations with fellow parents at Lily's playgroup: while everyone seems interested in NISA, especially with the 2024 reforms, many feel overwhelmed by the complexities of getting started. This reminds me of my own journey, filled with both uncertainty and discovery.

The Art of Choosing a NISA Partner: A Personal Journey

My search for the right NISA broker reminds me of finding the perfect kindergarten for Lily – it's not just about the facilities, but about finding a partner who aligns with your family's needs and values. After careful consideration, I chose Rakuten Securities for my NISA journey, primarily for their straightforward online setup process and seamless integration with Rakuten points.

The beauty of today's financial landscape is that there's no one-size-fits-all solution. Each brokerage offers unique advantages, from user interfaces to fee structures and additional services. While Rakuten Securities works perfectly for my needs, your ideal choice might be different based on your specific circumstances and preferences.

If you're weighing your options between different brokerages, I'm happy to share more detailed insights about my experience – just reach out. The most important thing is finding a platform that makes you comfortable and confident in your investment journey.

Our Family's Investment Blueprint: Looking Beyond Today

Our monthly NISA investment of ¥35,000 follows a carefully considered strategy:

Picture our investment portfolio as a well-balanced bento box:

The main portion (50%) goes to Nasdaq 100 through VOO, representing our core growth strategy

A substantial side dish (33%) in S&P 100 via QQQ adds stability

The garnish (17%) in Global Stocks through VT provides international flavor

This strategy might seem aggressive, but it's designed with specific family milestones in mind. Just as we're planning for Lily's international school education, our investment horizon stretches decades into the future.

Let me share a discovery that transformed my understanding of NISA's potential. Think of the Japan-US tax treaty as a special passport that reduces the usual 30% dividend tax to just 10% for Japanese residents. Combined with NISA's tax-free growth, this creates a powerful advantage for building long-term wealth.

Starting Your NISA Journey: A Family-Friendly Guide

Getting started with NISA is like preparing for your child's first day of school – it seems daunting until you break it down into simple steps:

Choose your broker (research different options and find what works best for you)

Gather your documents (My Number card and residency proof)

Complete the online application (about 30 minutes, perfect during naptime)

Await account approval (2-3 business days)

Make your initial investment

Starting Small, Thinking Big: The Power of Getting Started

Here's something I wish I had understood earlier: the biggest hurdle isn't how much you invest, but simply getting started. When I first opened my NISA account, I began with just ¥5,000 monthly while I built my confidence. What mattered most was having the account ready and the automatic investment set up – it's much easier to increase your contributions later than to make up for lost time.

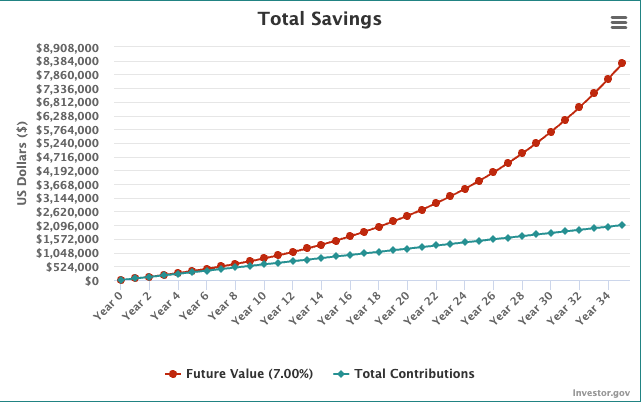

Let me share a perspective that transformed my thinking about early investing: If you start investing ¥5,000 monthly in your NISA account at age 30, assuming a 7% annual return, you could have approximately ¥8.2 million by age 65. Wait just five years to start, and you'd need to invest ¥7,500 monthly to reach the same goal. The magic of compound interest means that time in the market is often more powerful than timing the market.

Think of your NISA account like a garden – it's better to plant a few seeds today and add more gradually than to wait until you can afford a full garden. When I look at Lily, this long-term perspective makes even small monthly investments feel significant.

Looking Ahead: Growing Together

Our NISA strategy, like our family, is designed to grow and adapt. As my career at Paidy evolves toward my goal of doubling my current salary over the next decade, our investment approach will mature alongside our family's needs.

I'd love to hear about your family's investment journey. What challenges have you faced in starting your NISA account? How are you balancing current needs with long-term financial goals?

Share your thoughts by hitting reply – I read and respond to every message.

Building wealth together, Jason from Money Daruma

P.S. Considering a future post will feature my personally developed NISA tracking template, including practical tips for quarterly rebalancing that aligns with long-term family goals. What specific aspects would you like me to cover?